iBudge

Take control of your personal finances

iBudge is a personal finance app, designed to enable users to manage their money through a powerful and simple to use interface. Available on web, iOS (via the App Store) and Android (via the Google Play Store), iBudge is always available to support budgeting and financial planning.

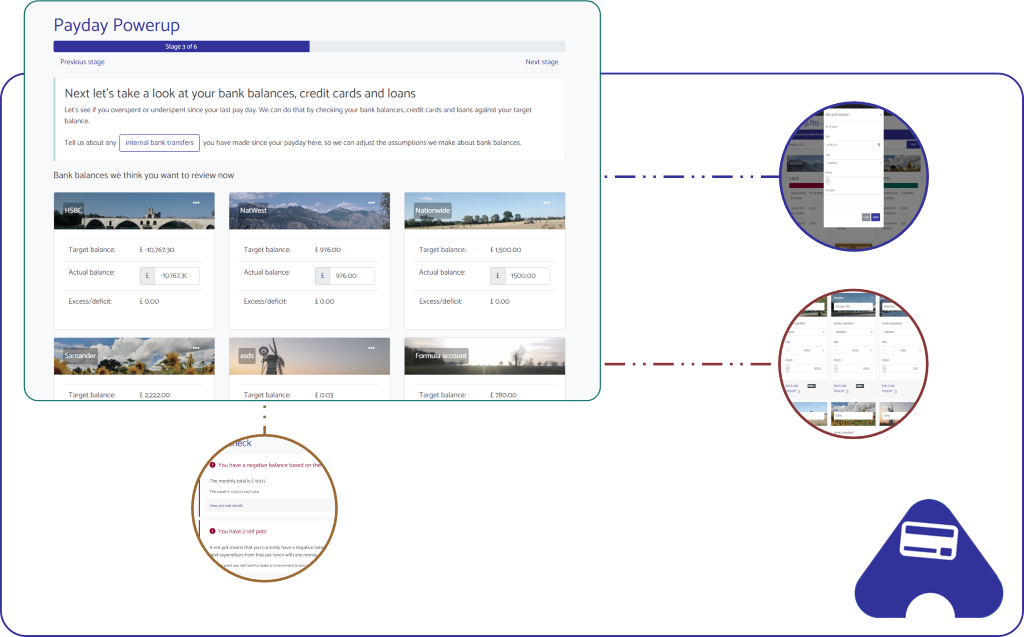

iBudge includes unique features, such as the Payday Powerup tool, which calculates how money should be apportioned after every payday - across different bank accounts (if applicable) and into defined savings pots. Other unique features include scenario planning and the Bonus LevelUp - enabling you to spread a bonus windfall across multiple periods.

Your money, your budget - simple.

- Calculate your income and expenditure: Use the iBudge prompts, or simply add from your own memory or records. As you add income and expenditure, the tool alutomatically updates your monthly balance to see if you have a surplus or deficit.

- Create savings pots: iBudge enables you to ringfence money for savings - perhaps holidays, Christmas, car servicing etc. And if there is an expense category that you want to be able to scrutinise, savings pots allow you to track every item of expenditure (and income) to give you full visibility.

- Capture bank accounts: iBudge is especially powerful for users who have multiple bank accounts. Perhaps one for bill payments, one for savings and one for day-to-day spending. Set a target balance for each month (positive or negative - or use a formula) and iBudge will prompt you to move your money to the right place and keep on track.

- Track credit cards and loans: Using a familiar and intuitive interface, you can add new cards and/or loans and then track all transactions made against them. Cards and loans pull through to your view of savings pots (simple and matrix views) so that you get complete visibility of your total financial situation.

- Manage stocks and shares: If you have invested in stocks and shares then you will likely wish to include these within your iBudge portfolio to track their performance. It is a simple process to add new stocks and shares, using the familar iBudge interface. You can add transactions (e.g. purchasing or selling shares) and update the share price at any time.

- Pensions: Planning for your retirement is hugely important - and a key component of this planning is the ability to track the funds available to you across your pensions. iBudge offers a simple solution to add each of your pensions and track the value of each of your schemes. You can either add transactions one at a time, or occasionally update the value of your pensions and the tool will automatically add the relevant transaction values for you.

- Property and mortgages: Owning a property is a significant financial investment - and iBudge provides the tools required to track the value of your property and its associate borrowing. iBudge users can track multiple properties - and multiple lines of borrowing against each property.

Get iBudge now

Online:

iOS (via the App Store):

Android (via Google Play Store):

Take control of your personal finances

- Payday Powerup: Payday Powerup is a unique guided decision making tool, which you should run after every payday. It doesn't take more than a minute or two to provide all of the information and then the system uses machine learning and inbuilt calculations to work out your surplus or deficit - and support you to decide how to assign this amount across a variety of options.

- Finance health monitoring: iBudge continuously monitors multiple aspects of your financial wellbeing to give you confidence of the current status of your money health. You can gain immediate visibility from the status header on the menu, which includes an indicator to show any issues (either amber or red depending on severity).

- Scenario planning: Our powerful Scenario Planning tool offers the ability to calculate the impact of changes, without affecting your live income and expenditure budget. Make as many changes as you like - and set up multiple scenarios if you wish. You can start from a blank template, or use an existing template (or your current live income and expenditure as a starting point). When you are ready, the tool guides you through the process to convert any scenario into your live income and expenditure.

- Bonus LevelUp: The iBudge Bonus LevelUp feature is designed to enable users to spread the benfits of a bonus across multiple pay periods. We allocate the bonus into a special pot and then release it back gradually so that you are able to spread the benefit across multiple months (the exact length chosen by you).

- Dashboards and reports: Harness a range of dashboards and reports to give you insights into your finances - and how you are spending your money. Compare your spending by period - and see how you are doing compared do your budget. Are there any areas of spending where you need to be more careful - or are you actually spending less than you thought? The dashboards and reports offer the tools you need to analyse your data.